Search Results: superannuation

-

AUSTRALIA

- Francine Crimmins

- 14 April 2017

15 Comments

As a millennial, I frequently find myself being told to stop complaining about housing affordability. It's all about working harder, saving more and, for goodness' sake, keeping off the avocado. As a young person, I'm concerned about using super, a system which was put aside for our economic welfare in retirement, as a savings account for instant gratification. The government is trying to solve the housing crisis not through direct action, but by encouraging young people into lifelong debt.

READ MORE

-

INTERNATIONAL

- Julie Davies

- 24 January 2017

11 Comments

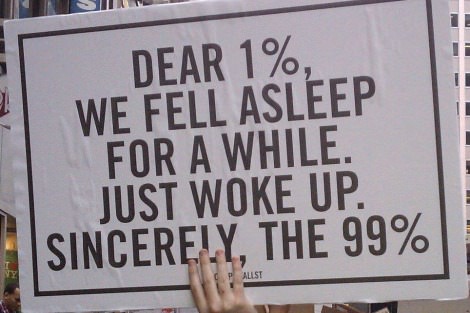

I can understand the Trump phenomenon. Hard-working Americans and many Australians are blaming various minorities as responsible for their decline. They are being blinded to the real culprits: our own governments and their wealthy backers. Juvenal's 'bread and circuses', designed to keep the people docile and distracted in Ancient Rome, have been updated to Maccas and manufactured news. And hatred. Are we so easily manipulated? Is the American model the future Australia wants for itself?

READ MORE

-

ECONOMICS

- Rachel Kurzyp

- 16 December 2016

8 Comments

Studies have found that in Australia, groups with the poorest financial awareness and skills are those under 25, those with no formal post-secondary education, those on low incomes and working 'blue collar occupations', and women. While it makes sense to provide these groups with financial information on home loans and super, this wouldn't have helped my mother when she had to decide between, say, buying groceries for the week or getting the car serviced.

READ MORE

-

AUSTRALIA

- Kate Galloway

- 25 November 2016

2 Comments

Civil society requires care work. All of us, at various stages of our lives, will be dependent on others for our daily needs. Most of us will likewise care for others at some point. The challenge is how to allocate caring responsibilities throughout society, while allowing also for the paid work that secures economic independence. At the moment the tacit expectation that women will do unpaid care work - and that men (theoretically) are unburdened by care work - contributes to economic inequality.

READ MORE

-

EDUCATION

- Dennis McIntosh

- 22 November 2016

24 Comments

I wondered why my daughter was able to get an education with a brain injury and I couldn't get one with a normal brain? So I decided to copy what we had done with her. In short, I started reading again and started patterning sentences. Do I care about Direct Instruction, or Noel Pearson and the Cape York Academy? No. I care about seeing children find the joy in learning and embracing with courage and confidence the opportunities an education can provide.

READ MORE

-

AUSTRALIA

- Rod Grant

- 18 November 2016

18 Comments

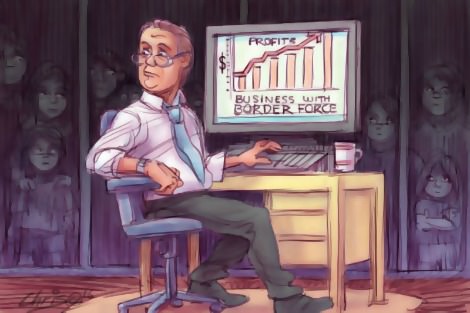

Having a sense of something as right or wrong, good or bad, is the essence of humanity. We get it from home, from education, religion, friends, the media. It's the sniff test or the pub test or the gut feeling or the Bible or Quran or Torah. We all have it. And just as people have a sense of right and wrong, we also have a very good humbug detector, and it's clanging loudly when politicians unctuously claim all their 'stop the boats' strategies are driven by desire to prevent drownings at sea.

READ MORE

-

ENVIRONMENT

- Thea Ormerod

- 09 September 2016

10 Comments

With the grip of climate change tightening, few seem to understand the urgency of the crisis. This is why the announcement of over 3500 churches in the UK switching to clean power is so significant. At last, a solution presented by religious communities that matches the scale of the problem. They are providing the kind of leadership for the needed transition to an ecologically sustainable future. Unfortunately, one reason why it is so exciting is that we're nowhere near this in Australia.

READ MORE

-

ENVIRONMENT

- Thea Ormerod

- 21 June 2016

4 Comments

An accelerating number of institutions and individuals are moving their money out of planet-heating fossil fuels and into climate solutions. The total assets guided by some form of divestment policy was $3.4 trillion at 2 December last year, 50 times more than what was up for divestment 12 months earlier. It sounds like a lot, but it's a small amount compared to the $100 trillion-plus invested in the usual way. That's our money, in banks and super funds, managed funds and insurance companies.

READ MORE

-

AUSTRALIA

- John Warhurst

- 06 May 2016

12 Comments

It was a political budget in a special sense, given the forthcoming election. Yet it turned out to be neither an election-winning nor election-losing budget. It was more continuity than change. In that sense it probably was the best the government could hope for given the nation's economic and financial circumstances. However it falls far short of the sort of budget that might have been expected from a prime minister like Malcolm Turnbull whose image is one off a 'big picture man'.

READ MORE

-

AUSTRALIA

- Fatima Measham

- 18 April 2016

10 Comments

People are sensitised to government-enabled corporate excess and doubt elected officials are capable and willing to serve their interests. The lesson from the 2014 federal budget is that there are non-negotiables around the function of government: to provide the conditions that ensure the flourishing of all citizens. Yet in terms of future-proofing living standards, the Coalition has so far presided over an ideas bust rather than boom, unless boom is the sound of something spontaneously combusting.

READ MORE

-

AUSTRALIA

- Andrew Hamilton

- 03 March 2016

9 Comments

Who better to consult than Dr Hippocrates and his humours? Before Tony Abbott's deposition the choleric element dominated in Australia, full of sound and fury. This has been followed by the preponderance of the sanguine humour, expressing itself in that sunny optimism that makes light of problems. But more recent events suggest that the humours are again in chronic imbalance. The core weakness in the Australian constitution has not been removed with the accession of Malcolm Turnbull.

READ MORE

-

ENVIRONMENT

- Mark Copland

- 02 November 2015

10 Comments

When Chinchilla farmer George Bender took his own life, it ended a ten year struggle with the coal seam gas industry that has wreaked havoc on his property and that of his neighbours. Despite mountains of paper regulations, despite a well-resourced Gasfield Commission and Gasfield Compliance Unit, people in the region feel abandoned. It seems that government bodies are enablers and facilitators of the industry rather than regulators and protectors of the people, the soil and the water.

READ MORE