Keywords: Global Financial Crisis

There are more than 200 results, only the first 200 are displayed here.

-

RELIGION

- David Halliday

- 17 March 2023

8 Comments

Over 17,000 women worldwide have called for Church reform in a newly published survey by Catholic Women Speak Network. Respondents from 104 countries expressed dissatisfaction with a lack of transparency in governance and voiced the need to be seen, heard and valued.

READ MORE

-

AUSTRALIA

- David Halliday, Peter Mares, John Falzon, Nicola Nemaric, Rae Dufty-Jones

- 18 November 2022

1 Comment

Despite rising interest rates and the recent dip in property values, Australia’s housing situation places it among the least affordable property market in the world. With a rise in homelessness and younger Australians locked out of an inflated housing market, what is the way forward for Australia?

READ MORE

-

ECONOMICS

- David James

- 16 November 2022

1 Comment

Financial markets are made up of human beings and human beings have always been storytellers — long before science, or modern finance, or accounting even existed. Accordingly, the main skill of successful analysts, advisers, financial gurus and commentators is the construction of compelling narratives. They are, if not exactly creators of fairy stories, not too far removed from it.

READ MORE

-

ECONOMICS

- David James

- 28 October 2022

Who wields the most power in the world? If one follows the money trail, it becomes clear that Western societies have become ruled by a new type of aristocracy: a management aristocracy.

READ MORE

-

ECONOMICS

- David James

- 18 October 2022

3 Comments

The world is facing cross-currents: a collapsing financial system that is balanced by the benefits of massive, long term improvements in production efficiencies, mainly because of technological advances. It is a bad news/good news story that can only be seen accurately if the intractable errors of contemporary economics are jettisoned. We are in a battle between finance fictions and reality.

READ MORE

-

ECONOMICS

- David James

- 03 October 2022

5 Comments

For Europe, especially Germany, there should be enough gas in storage to limp through winter but by next spring there may be severe trouble. The leaders of Europe and the United States expected that they would win the economic war against Russia and force the invader to withdraw. Not only did that not happen, it is likely to lead to severe unintended economic consequences.

READ MORE

-

ECONOMICS

- David James

- 23 August 2022

4 Comments

Now that it is becoming hard to avoid just how much trouble the global financial system is in, it is interesting to speculate about what should be done about it. The first thing to understand about the global financial system is that the assumptions that were used to shape it are demonstrably false.

READ MORE

-

ECONOMICS

The question that should be posed is how effective has the Reserve Bank been at ‘managing’ the economy and financial system? ‘Not very’, has to be the answer. Not that the RBA is alone. The same pattern has been seen across the developed world. Central banks have one weapon at their disposal, the cost of money (the interest rate), and there is not much evidence they have used this tool to make their systems sustainable. Mostly, they have made matters worse.

READ MORE

-

ECONOMICS

As commodity prices and inflation soar in the ‘real’ world we may be witnessing a prelude to another 2008-style crisis triggered by the foreign exchange markets. The risks certainly look similar and can be described with a simple question. Can the fictions produced by out-of-control financial actors survive reality?

READ MORE

-

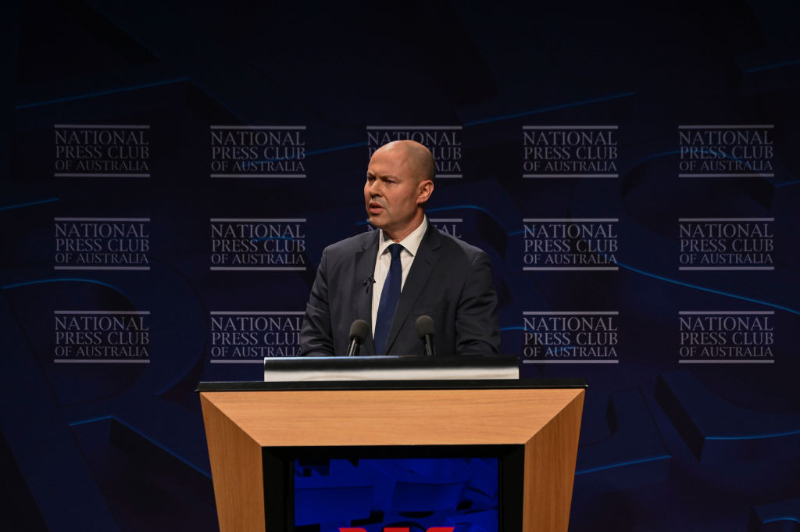

ECONOMICS

- Julian Butler

- 31 March 2022

In 2020 as the Covid-19 pandemic raged globally, as Australia shut its borders and some states shut in their people, massive government income support was introduced. The government was a little slow coming to recognise the need for such measures. Once they had, they wanted the support rolled out as quickly as possible. Frydenberg, Scott Morrison and their colleagues recognised that a demand side boost was absolutely necessary to sustain economic activity. The government was uncomfortable, though, with this approach.

READ MORE

-

ECONOMICS

- David James

- 01 March 2022

3 Comments

Australia’s Reserve Bank mainly concentrates on keeping inflation within an acceptable range and maintaining a high level of employment. Social equity has never been considered to be part of its mandate. It should be. Interest rates have been the biggest cause of economic and social division in Australia, not just between rich and poor, but also between older and younger generations.

READ MORE

-

ARTS AND CULTURE

- Barry Gittins

- 14 January 2022

1 Comment

We’ve been in a pressure cooker, these past two years. More than a score of historians had memorably described 2020 as the sixth-most ‘stressful year ever’. Predictions and speculations look ahead; I looked at the past trends of the past two years and make these humble observations. With the stage set for dire times, here are six trends to look for in 2022. Here’s hoping.

READ MORE