Keywords: Global Financial Crisis

There are more than 200 results, only the first 200 are displayed here.

-

ECONOMICS

- David James

- 06 December 2021

1 Comment

If Australia does draw back from globalisation — as opposed to trade, which will continue — then there should be more focus on our primary sector and how it could be better financed. Australia’s long history as a primary producer constitutes what economists call a ‘comparative advantage’: an economic area in which a country does best while giving up the least.

READ MORE

-

ECONOMICS

- David James

- 08 November 2021

1 Comment

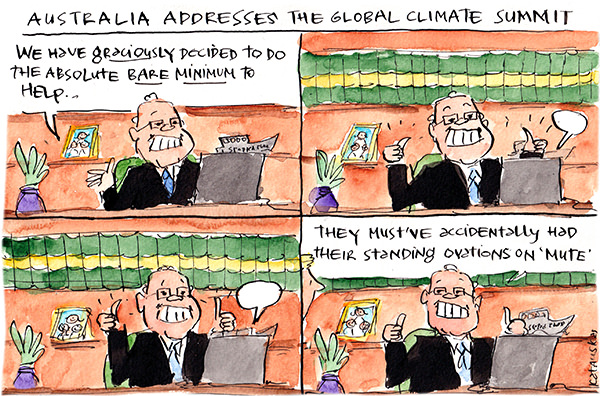

The Glasgow United Nations Climate Change Conference has been advertised as an effort to focus on sustainable environmental solutions. What got much less attention, if any, is that it is probably at least as much about having a sustainable financial system. Many noted that China, did not send its leader: Xi Jinping, president of the world’s greatest CO2 emitter. There was also another significant absence: the financiers who are hoping to profit from the trillions allocated into climate change projects.

READ MORE

-

ECONOMICS

- David James

- 12 October 2021

3 Comments

Over the last two years, money printing has created the illusion of strength in savings. But when reality resurfaces, and actual returns are required from actual economic and business activity, the global financial system will come under extreme stress.

READ MORE

-

ECONOMICS

- David James

- 12 August 2021

4 Comments

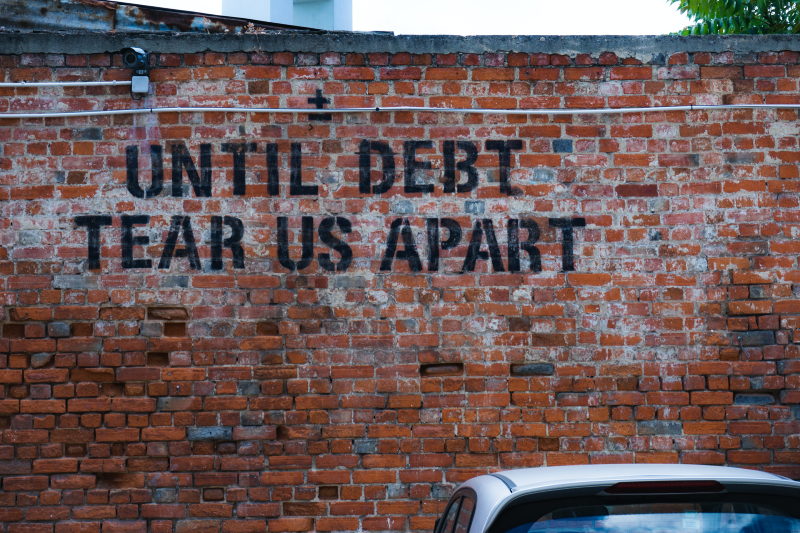

The biggest mystery of the financial markets is why, when the monetary authorities have been printing money with their ears pinned back, is inflation for the most part not a problem? What happens with inflation is crucial to the short-term survival of the whole system. Global debt, which is running at well over 300 per cent of global GDP, is only sustainable because interest rates are exceptionally low (the base rate in Australia is only 0.1 per cent). And interest rates are low because inflation is not a problem.

READ MORE

-

ECONOMICS

An often overlooked fact about the financial system is that it entirely depends on trust. When trust starts to evaporate, especially between the big players such as banks and insurance companies, the whole artifice is put into peril. Trust in the system is now at an extreme low and that points to extreme danger.

READ MORE

-

ECONOMICS

But although the Coalition will never admit it, it looks suspiciously like there has been some bipartisan institutional learning about how to manage financial crises. If you want to stimulate an economy in times of crisis put the money directly into the economy, either into people’s pockets or to businesses who then pass it on to workers.

READ MORE

-

ECONOMICS

- David James

- 10 December 2020

1 Comment

The world’s financial markets are afflicted by a deep irrationality that imperils their very existence. On the surface, finance looks logical enough with its numbers, charts, mathematics, forecasts, ‘modelling’ and so on. But this only masks the fact that the system itself has been working on underlying assumptions that are either contradictory — such as that you can ‘deregulate’ finance when finance consists of rules — narrow minded or absurd.

READ MORE

-

CARTOON

- Fiona Katauskas

- 08 December 2020

READ MORE

-

ECONOMICS

- David James

- 20 October 2020

3 Comments

The global economy was already teetering on the edge of such a debt crisis before the coronavirus hit. The economic shutdowns have accelerated the damage.

READ MORE

-

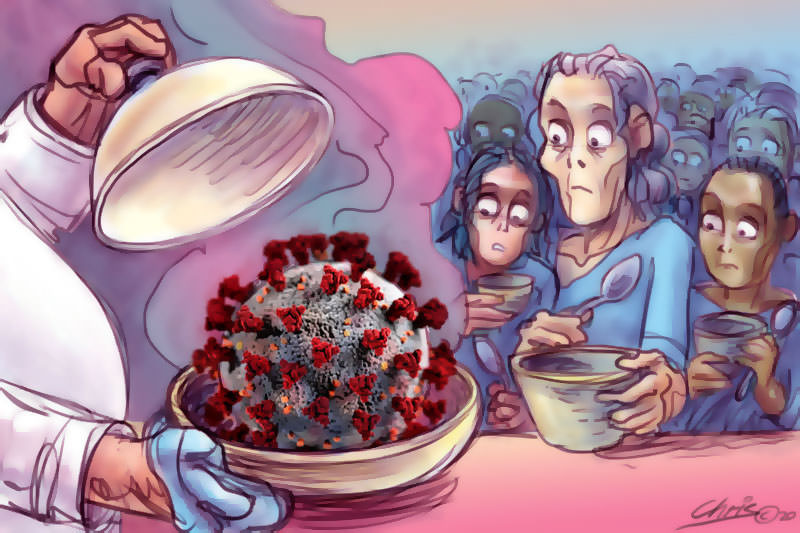

INTERNATIONAL

- Maddison Moore

- 01 September 2020

2 Comments

The global impact of COVID-19 has further increased inequality in food security, with nations already facing widespread famine, malnutrition and food insecurity being hit the hardest.

READ MORE

-

ECONOMICS

- David James

- 20 August 2020

6 Comments

There will be Great Reset in finance and economics. It is inevitable because the shock has been so great. The first problem is what to do with global debt, which was already at unsustainable levels before the virus hit: over 320 per cent of global GDP. The only way to prevent system-wide failure has been to lower interest rates to near zero levels.

READ MORE

-

ECONOMICS

The full economic impact of the coronavirus lockdowns will not be fully felt until the end of the year, but it will be devastating. The Treasurer, Josh Frydenberg, is already estimating that the effective employment rate is 13.3 per cent; it may be headed for as high as 20 per cent. It raises a question, not just in Australia, but in many developed countries. Will there be a significant middle class left after such economic destruction?

READ MORE