Keywords: Us Federal Reserve

-

ECONOMICS

- David James

- 18 October 2022

3 Comments

The world is facing cross-currents: a collapsing financial system that is balanced by the benefits of massive, long term improvements in production efficiencies, mainly because of technological advances. It is a bad news/good news story that can only be seen accurately if the intractable errors of contemporary economics are jettisoned. We are in a battle between finance fictions and reality.

READ MORE

-

ECONOMICS

As commodity prices and inflation soar in the ‘real’ world we may be witnessing a prelude to another 2008-style crisis triggered by the foreign exchange markets. The risks certainly look similar and can be described with a simple question. Can the fictions produced by out-of-control financial actors survive reality?

READ MORE

-

ECONOMICS

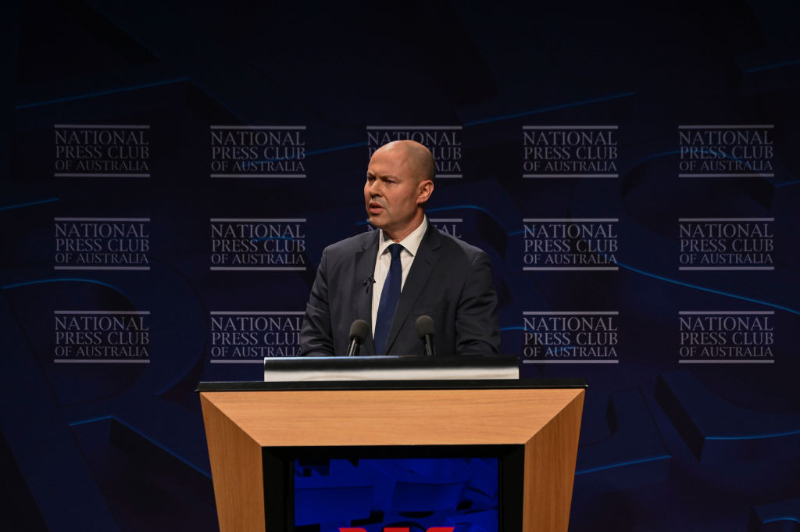

In purely economic terms, the upcoming Federal election is extremely unusual. The shut down of the Australian economy for almost two years because of health measures really has no precedent in our history. Only war can produce that type of shock. The Federal government’s financial response was as extreme as the state of emergency measures, including a sharp increase in Australian government debt. It remains to be seen, however, if the government gets much credit for injecting so much free money into the economy. It is unlikely.

READ MORE

-

ECONOMICS

- Julian Butler

- 31 March 2022

In 2020 as the Covid-19 pandemic raged globally, as Australia shut its borders and some states shut in their people, massive government income support was introduced. The government was a little slow coming to recognise the need for such measures. Once they had, they wanted the support rolled out as quickly as possible. Frydenberg, Scott Morrison and their colleagues recognised that a demand side boost was absolutely necessary to sustain economic activity. The government was uncomfortable, though, with this approach.

READ MORE

-

ECONOMICS

- David James

- 01 March 2022

3 Comments

Australia’s Reserve Bank mainly concentrates on keeping inflation within an acceptable range and maintaining a high level of employment. Social equity has never been considered to be part of its mandate. It should be. Interest rates have been the biggest cause of economic and social division in Australia, not just between rich and poor, but also between older and younger generations.

READ MORE

-

ECONOMICS

- David James

- 31 January 2022

5 Comments

There is a great deal of commentary about the growing importance of artificial intelligence, or AI, especially in business circles. To some extent this is a self-fulfilling prophecy — if people think something will have a seminal effect then it probably will. But if the supposed commercial benefits are significant, the dangers are potentially enormous.

READ MORE

-

ENVIRONMENT

- Brian Matthews

- 03 June 2021

6 Comments

Red gum, this ‘smooth-barked large tree that gives watercourses all over Australia their Australian feel’, seemed intent on bobbing up in my life one way or another, sometimes as a result of sheer luck or coincidence.

READ MORE

-

FAITH DOING JUSTICE

- Julian Butler

- 11 February 2021

4 Comments

The size and spread of government payments in past 12 months has held steady, and to some extent, improved the circumstances of many on low incomes or government support. The withdrawal of that support risks returning many to payments that do not provide for basic human needs.

READ MORE

-

ECONOMICS

- David James

- 10 December 2020

1 Comment

The world’s financial markets are afflicted by a deep irrationality that imperils their very existence. On the surface, finance looks logical enough with its numbers, charts, mathematics, forecasts, ‘modelling’ and so on. But this only masks the fact that the system itself has been working on underlying assumptions that are either contradictory — such as that you can ‘deregulate’ finance when finance consists of rules — narrow minded or absurd.

READ MORE

-

ECONOMICS

- David James

- 20 October 2020

3 Comments

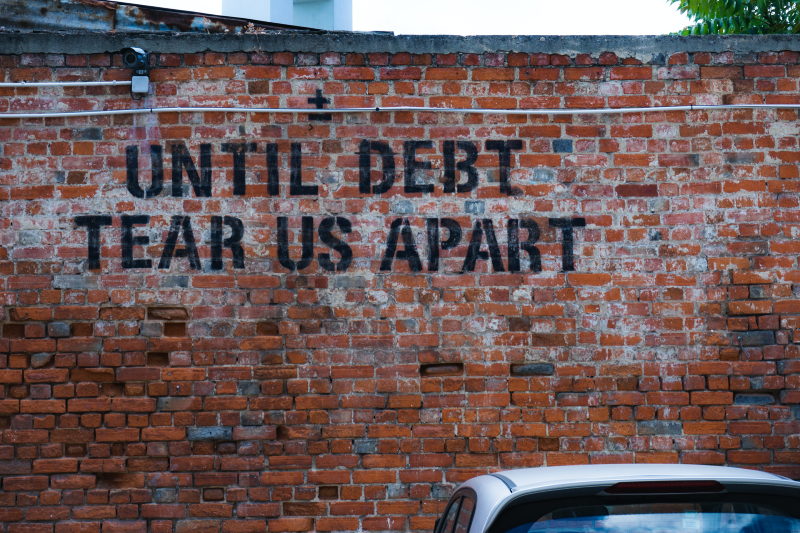

The global economy was already teetering on the edge of such a debt crisis before the coronavirus hit. The economic shutdowns have accelerated the damage.

READ MORE

-

ECONOMICS

- David James

- 20 August 2020

6 Comments

There will be Great Reset in finance and economics. It is inevitable because the shock has been so great. The first problem is what to do with global debt, which was already at unsustainable levels before the virus hit: over 320 per cent of global GDP. The only way to prevent system-wide failure has been to lower interest rates to near zero levels.

READ MORE

-

ARTS AND CULTURE

- Tim Robertson

- 21 July 2020

9 Comments

Craftsmanship is a way of seeing and understanding mediated through touch and feel and the body. While the finished product or the stated goal are important, the process — as an act of learning, making mistakes, experiencing both frustration and satisfaction — is equally (if not more) important.

READ MORE