Keywords: Us Federal Reserve

-

AUSTRALIA

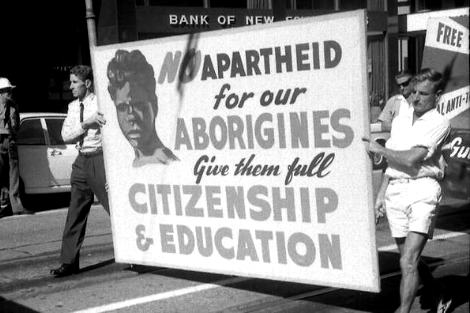

An interesting aspect was the shift in the mindset and understanding among non-indigenous Australians regarding Aboriginal rights. To note the way in which one dominating western culture moved toward recognising the rights of another culture that was oppressed by it is quite remarkable. We should consider those aspects of the mentality shift (from both cultures and their understanding of what the 1967 referendum meant) if we are ever to revisit that type of federal movement again.

READ MORE

-

ECONOMICS

The $6.2 billion the government will raise through a levy on bank liabilities not only shows how out of favour banks have become, it is also, in effect, a de facto tax on property lending - a counterbalance to negative gearing and capital gains tax breaks. It is a tax on property lending because nearly all the banks' loans are mortgages for housing, or business loans secured with property. Of course the banks will pass the extra cost on to their customers, so it becomes a tax on borrowers.

READ MORE

-

AUSTRALIA

- Frank Brennan

- 13 October 2016

2 Comments

With idealism and pragmatism, I invite you criminal lawyers in the next 30 years to imagine and enact a better criminal justice system which alleviates rather than exacerbates the devastating effects of colonisation and marginalisation on Indigenous Peoples, and most particularly their children. An intelligently designed criminal justice system must help secure the foothold of Indigenous children in both the Market and the Dreaming.

READ MORE

-

AUSTRALIA

- Fatima Measham

- 18 April 2016

10 Comments

People are sensitised to government-enabled corporate excess and doubt elected officials are capable and willing to serve their interests. The lesson from the 2014 federal budget is that there are non-negotiables around the function of government: to provide the conditions that ensure the flourishing of all citizens. Yet in terms of future-proofing living standards, the Coalition has so far presided over an ideas bust rather than boom, unless boom is the sound of something spontaneously combusting.

READ MORE

-

ECONOMICS

- David James

- 19 January 2016

11 Comments

Low interest rates tend to change the understanding of risk; having high debt seems to be less of a problem because the cost of servicing it is lower. This cavalier attitude has been especially evident in Australian households, which have racked up more debt relative to the size of the economy than any other country in the world. The massive appetite for debt has been replicated across the globe. The world may have survived the era of casino money - just - but it is now facing another crisis.

READ MORE

-

ECONOMICS

- David James

- 10 December 2014

12 Comments

One of the fascinating aspects of Australia's political pantomime is the manner in which the Federal Treasurer is forced to metamorphose into a used car salesman who is spruiking the Australian economy. One reason for the relative impotence of the Treasurer is that the Federal government only has control over fiscal policy. Monetary policy, the interest rate, is set by the Reserve Bank, not the government.

READ MORE

-

ECONOMICS

- David James

- 08 September 2014

7 Comments

What is only now starting to come into focus is the extent to which the whole economy is in hock to house prices. A sharp fall in the housing market will put intense pressure on our major lending institutions, leading to a deeply depressing effect on all parts of the economy. The regulators, as ever, are taking a hands-off approach.

READ MORE

-

AUSTRALIA

- Michael McVeigh

- 15 April 2014

22 Comments

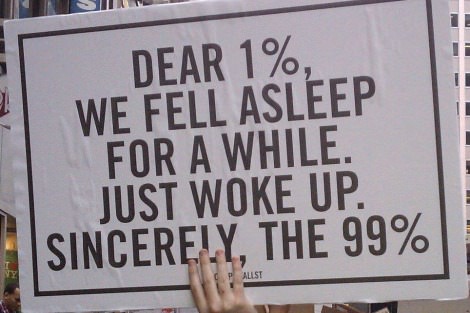

On Sunday, tens of thousands of people took to the streets to protest the Government's treatment of asylum seekers. This wasn't a group of radicals — it was Grandma and Grandpa, Mum and Dad and the kids, making a statement to a callous political elite. Rather than simply asking how we can become more decent towards asylum seekers, it's time to ask: What reserves do we, as a country, have to resist inhumane forces that besiege us?

READ MORE

-

AUSTRALIA

- Michael Mullins

- 07 April 2014

7 Comments

Federal Treasury secretary Martin Parkinson has called on the Government to increase the GST. In isolation this would hurt the poor and benefit the rich. But it could help the common good if it is part of a tax reform package that cuts tax avoidance strategies for high income earners, including superannuation concessions, negative gearing and trusts.

READ MORE

-

ECONOMICS

- David James

- 10 December 2013

15 Comments

It is hard not to smile over Woolworths' and Coles' 'voluntary' adoption of a code of conduct. Now that the duopoly has decided to mend its ways, it seems it can occupy the moral high ground and preach to everyone else. The Western world has been subject to a quarter of a century of propaganda about the virtues of deregulation. A closer consideration of the supermarket giants' promise to do the right thing offers little reason for confidence.

READ MORE

-

ECONOMICS

- David James

- 04 October 2013

1 Comment

America is fond of claiming exceptionalism, which is usually little more than an indication of its attitude to moral accountability. But in one area America definitely is exceptional: the global currency markets. There is no risk of the market for American dollars drying up, which means that a default by the American government is, while significant, not especially relevant to what happens with the global trade in US dollars.

READ MORE

-

AUSTRALIA

- Benedict Coleridge

- 06 September 2013

11 Comments

Throughout the electoral fracas over boat arrivals, Tony Abbott has been keen to isolate Australia's border control challenges from any international context: in his terms they are 'Australia's problem'. He may deny it, but the Opposition Leader knows full well that the Australian discussion is part of an international debate about responses to people movement. A historical perspective helps to illuminate this.

READ MORE