Keywords: Economics

There are more than 200 results, only the first 200 are displayed here.

-

ECONOMICS

- Julian Butler

- 31 March 2022

1 Comment

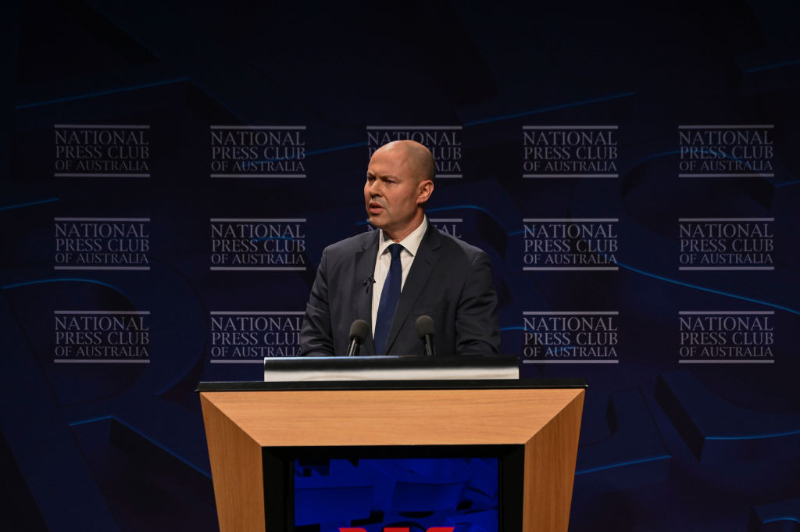

In 2020 as the Covid-19 pandemic raged globally, as Australia shut its borders and some states shut in their people, massive government income support was introduced. The government was a little slow coming to recognise the need for such measures. Once they had, they wanted the support rolled out as quickly as possible. Frydenberg, Scott Morrison and their colleagues recognised that a demand side boost was absolutely necessary to sustain economic activity. The government was uncomfortable, though, with this approach.

READ MORE

-

INTERNATIONAL

- Joel Hodge

- 25 February 2022

28 Comments

President Putin of Russia has embarked on an unprecedented military campaign in Ukraine without direct provocation or justification. In the West, there is a feeling of disbelief and confusion. How can Putin do this? And how can the Russian people accept this invasion?

READ MORE

-

MEDIA

- Binoy Kampmark

- 11 January 2022

1 Comment

Instead of retaining its control of a fruit market, or preserving an oil monopoly, Facebook harnesses another resource: data. Any regulator or sovereign state keen to challenge the way the Silicon Valley giant gathers, monetises and uses that data will face their ire.

READ MORE

-

ECONOMICS

- John Falzon

- 04 January 2022

7 Comments

When you put rising housing costs alongside stagnating wages, an alarming trend in normalising insecure work, persistent unemployment and underemployment, and statutory incomes that are going backwards in real terms, there’s good reason to be deeply worried about an increase in homelessness.

READ MORE

-

AUSTRALIA

- Andrew Hamilton

- 04 November 2021

13 Comments

In large organisations love hardly rates a mention. Mission statements highlight care, duty, responsibility and friendliness, but not love. Love is generally seen as an interrupter, combustible, something to fence in with protocols and professional standards, and for HR to monitor. When Pope Benedict XVI devoted an Encyclical to the place of love in public relationships, people were surprised. His argument is worth revisiting.

READ MORE

-

AUSTRALIA

- Julian Butler

- 01 November 2021

21 Comments

The elevation of Dominic Perrottet to the Premiership of New South Wales caused a flurry of commentary about his religious faith. In many parts of the media his politics and personality were framed by his Catholicism. I watched on with a degree of discomfort, and with a sense of possibility. Could some of the bigoted characterisations invite a richer conversation about the ideals and deeper narratives that enliven our public leaders?

READ MORE

-

ECONOMICS

- David James

- 12 October 2021

4 Comments

Over the last two years, money printing has created the illusion of strength in savings. But when reality resurfaces, and actual returns are required from actual economic and business activity, the global financial system will come under extreme stress.

READ MORE

-

ECONOMICS

- David James

- 07 September 2021

4 Comments

There is a three-way battle looming over the future of money and the stakes could scarcely be higher. Conventional money, mainly debt created by banks — the ‘folding stuff’ is only a tiny proportion of the total — is in trouble. Total global debt is now so large relative to the world economy it cannot be serviced, which is why monetary authorities have resorted to dropping interest rates. When they almost hit zero, the next step was quantitative easing (QE): printing money by getting the central bank to buy back government and corporate bonds and putting them on its ‘balance sheet’.

READ MORE

-

ECONOMICS

- Chris Smith

- 31 August 2021

11 Comments

In July, Anthony Albanese announced a significant change of stance on Labor tax policy which was disappointing, if not surprising. An elected Labor government, Albanese promised, would keep the coming high income tax cuts he previously opposed. This decision to not oppose the government proposal to restructure the income tax system through reduced marginal rates is supporting a government policy that will lead to a significant redistribution of wealth towards high income earners.

READ MORE

-

ARTS AND CULTURE

- Gillian Bouras

- 19 August 2021

10 Comments

My son’s Athenian flat was burgled last month. I had been visiting Athens for the first time in more than a year, and so was with the family when they arrived back, after a fairly brief evening absence, to sheer chaos. Anybody who has had this experience will be able to picture the scene: every drawer and cupboard had been opened, with the contents spilled and strewn everywhere. Even the loft had been checked.

READ MORE

-

AUSTRALIA

- Frank Brennan

- 17 August 2021

9 Comments

Last Wednesday, the Senate Standing Committee for the Scrutiny of Delegated Legislation chaired by the Government’s Senator Concetta Fierravanti-Wells tabled a report highlighting problems with a proposed new regulation affecting charities.

READ MORE

-

ECONOMICS

- David James

- 12 August 2021

4 Comments

The biggest mystery of the financial markets is why, when the monetary authorities have been printing money with their ears pinned back, is inflation for the most part not a problem? What happens with inflation is crucial to the short-term survival of the whole system. Global debt, which is running at well over 300 per cent of global GDP, is only sustainable because interest rates are exceptionally low (the base rate in Australia is only 0.1 per cent). And interest rates are low because inflation is not a problem.

READ MORE