Keywords: Global Financial Crisis

There are more than 200 results, only the first 200 are displayed here.

-

ECONOMICS

- David James

- 08 November 2017

3 Comments

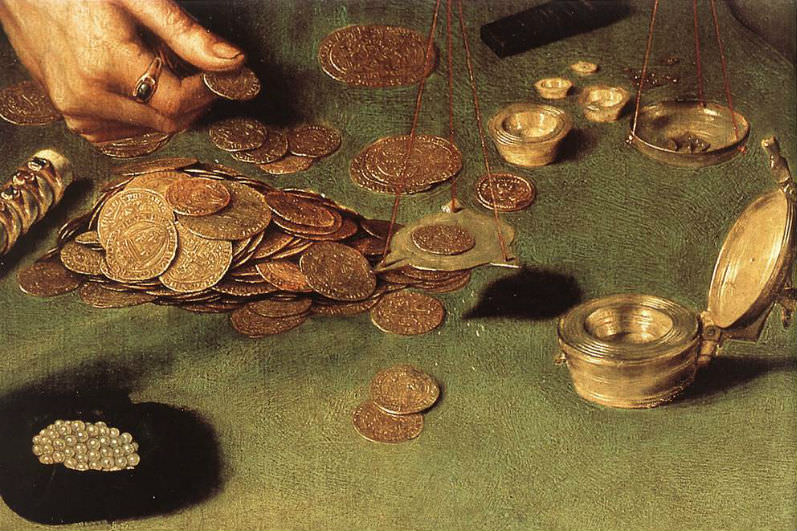

Once upon a time, usury was considered a sin and lending was subject to strict controls. Now, the world is in the grip of usury. It cannot continue. At some point it will have to be retired, or swapped to equity. A good place to start is third world debt, which is the most immoral variant.

READ MORE

-

ECONOMICS

The daily fluctuations of financial markets and the fractious debates over economic policy are concealing something deeper and much more disturbing. The future of money itself is in question. A decade after world banking almost collapsed in the global financial crisis, the questions raised have not been answered.

READ MORE

-

ECONOMICS

One thing that is rarely done is a literary-style analysis of the language used in finance and business. It can quickly reveal the sleight-of-hand, even outright deception, that plague these powerful sectors. To take one example, finance language heavily relies on water metaphors, which are deeply misleading. It is unlikely that this is done deliberately; it is more probably reification (making the intangible appear to be concrete). But its consequences have been, and remain, devastating.

READ MORE

-

RELIGION

- Frank Brennan

- 08 May 2017

1 Comment

Our Church is presently a strained, outdated social institution with an exclusively male hierarchy and clergy. But it is also the privileged locus for us to be called to the banquet of the Lord sharing theology and sacrament which have sustained the hearts and minds of similar pilgrims for two millennia. Thank God for Pope Francis who is showing us the way, helping us to find meaning in our changing and chaotic world, putting a fresh spring in the step of all those Catholics holding in tension the prophetic and the practical, the theological and the humanist, the tradition and the contemporary reality.

READ MORE

-

AUSTRALIA

- Frank Brennan

- 07 May 2017

7 Comments

Part of the cost of the double dissolution election last July has been the creation of a Senate with the largest, most diverse group of crossbenchers ever. This will make the passage of any new contested Budget measures difficult, particularly given the Prime Minister’s vulnerability on his right flank, and the Labor Party's propensity to mimic the Opposition tactics adopted previously by Tony Abbott. The government needs to create a clear narrative as to how it will achieve equitable and sustainable growth through this Budget.

READ MORE

-

INTERNATIONAL

- Catherine Marshall

- 25 January 2017

30 Comments

No-one doubted Trump's ascendancy would deeply fracture the world as we know it. But few of us could have anticipated the swiftness with which his orders would impact some of the world's most disadvantaged citizens: vulnerable, impoverished women. With just one signature, the newly-installed president snatched from these women access to services that are essential to their physical and mental wellbeing and their economic prospects - and, in so doing, endangering countless lives.

READ MORE

-

INTERNATIONAL

- Julie Davies

- 24 January 2017

11 Comments

I can understand the Trump phenomenon. Hard-working Americans and many Australians are blaming various minorities as responsible for their decline. They are being blinded to the real culprits: our own governments and their wealthy backers. Juvenal's 'bread and circuses', designed to keep the people docile and distracted in Ancient Rome, have been updated to Maccas and manufactured news. And hatred. Are we so easily manipulated? Is the American model the future Australia wants for itself?

READ MORE

-

ECONOMICS

- Veronica Sheen

- 13 December 2016

5 Comments

Over the last two decades we have seen a process of job polarisation. There has been growth in high end jobs, but mostly in low end jobs, the outcome of which has been the hollowing out of middle level jobs. This hollowing out of the middle also relates to greater wealth polarisation, as French economist Thomas Piketty has brought to light. The labour market is under a lot of pressure from many angles, so what does this mean for the project of women's equal opportunity in employment?

READ MORE

-

ENVIRONMENT

- Frank Brennan

- 28 November 2016

'No matter what the economic, political and legal problems confronted by modern day India, our response can be improved by an application of the key principles and norms developed in the international law of trade and human rights, helping to enunciate the realm of law, regulation and political accountability, enhancing public scrutiny providing the right environment for doing business.' Frank Brennan presents the 25th JRD Tata Oration, Xavier School of Management, Jamshedpur, India, 26 November 2016.

READ MORE

-

ECONOMICS

- David James

- 10 October 2016

2 Comments

The strategy of the Big Four banks' appearance in parliament was clear enough. Blame the whole thing on a need to improve impersonal 'processes', imply that there have been a few bad apples but overall things are fine, and promise to do better in the future. The greatest challenge was probably to hide the smirks. A royal commission is being held up as an alternative, and no doubt it would be more effective. But a royal commission would not address the main issue.

READ MORE

-

ENVIRONMENT

- Thea Ormerod

- 09 September 2016

10 Comments

With the grip of climate change tightening, few seem to understand the urgency of the crisis. This is why the announcement of over 3500 churches in the UK switching to clean power is so significant. At last, a solution presented by religious communities that matches the scale of the problem. They are providing the kind of leadership for the needed transition to an ecologically sustainable future. Unfortunately, one reason why it is so exciting is that we're nowhere near this in Australia.

READ MORE

-

ARTS AND CULTURE

- Tim Kroenert

- 25 August 2016

War Dogs is the latest in a string of films from the past few years that are custom made for our cynical times; deeply ironic black comedies and dramas featuring antiheroes who profit to the point of excess off the misery of others. Where those films dealt with the finance industry and gained relevance from the backdrop of the Global Financial Crisis, this one shifts focus to the grimier world of arms dealing, in the context of Bush era conflict in Iraq and Afghanistan.

READ MORE