Keywords: James Price Point

-

ECONOMICS

As the world economy groans under soaring levels of debt, the place to look is Japan, whose current government debt-to-GDP ratio is an eye watering 253 per cent. It is Japan, which led the developed world into this mess, that is likely to lead the world out of it by cancelling debt. The consequences of such a move would be far reaching.

READ MORE

-

INTERNATIONAL

- Rachel Woodlock

- 14 November 2017

7 Comments

These lone-wolf terrorists are more like miners' canaries. Whether it is a paranoid loner, an enraged ideologue, a jihadist or a white supremacist, they are screaming out at the top of their lungs that something is terribly wrong.

READ MORE

-

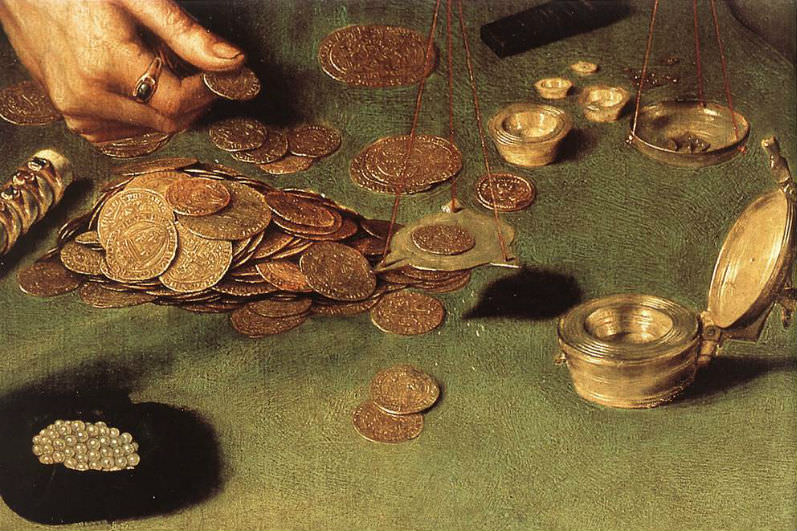

ECONOMICS

- David James

- 08 November 2017

3 Comments

Once upon a time, usury was considered a sin and lending was subject to strict controls. Now, the world is in the grip of usury. It cannot continue. At some point it will have to be retired, or swapped to equity. A good place to start is third world debt, which is the most immoral variant.

READ MORE

-

MEDIA

- David James

- 26 September 2017

3 Comments

There are very few examples of companies that have been able to genuinely change when confronted with new circumstances. It looks increasingly that Facebook and Google are approaching this situation. The challenge is likely to come from some quarter that is new and surprising, just as the demolition of conventional media came from companies that could have barely been imagined 20 years ago.

READ MORE

-

ARTS AND CULTURE

- Megan Graham

- 16 August 2017

One lone man daring to interfere with the evil plans of the rich and powerful: it’s not exactly a new angle, but there are a few scraps of satisfaction to be found in Joel Hopkin’s latest film Hampstead – just not in the realm of originality. It’s a sleepy story that meanders along with a mildly pleasant mediocrity.

READ MORE

-

ECONOMICS

- David James

- 07 March 2017

17 Comments

Witnessing the debate over Sunday penalty rates, an intriguing pattern of thinking emerged. It can be characterised as a microcosm/macrocosm duality. Those arguing for lower Sunday wage rates demonstrate their case by talking about individual businesses, the micro approach: 'Many businesses would love to open on a Sunday and if wage rates were lower, they would. Unleash those businesses and greater employment will follow.' Superficially impressive, this does not survive much scrutiny.

READ MORE

-

ECONOMICS

- David James

- 10 October 2016

2 Comments

The strategy of the Big Four banks' appearance in parliament was clear enough. Blame the whole thing on a need to improve impersonal 'processes', imply that there have been a few bad apples but overall things are fine, and promise to do better in the future. The greatest challenge was probably to hide the smirks. A royal commission is being held up as an alternative, and no doubt it would be more effective. But a royal commission would not address the main issue.

READ MORE

-

ECONOMICS

- David James

- 13 October 2014

7 Comments

Federal Finance Minister Mathias Cormann announced 'the scoping study found no evidence that premiums would increase as a result of the sale' of Medibank Private. But the sale is being presented as a way to make the fund more efficient. If successful, Medibank Private will become even more dominant than it is at present and there will be pressure to raise premiums to achieve its purpose of keeping shareholders happy.

READ MORE

-

ARTS AND CULTURE

- Tim Kroenert

- 03 July 2014

5 Comments

Ensconced in the anonymity of the confessional, a man who suffered injustice at the hands of the Church informs the priest, Fr Lavelle, that he plans to kill him. The killer's reason for wanting to inflict violence is that he was, as a child, a victim of abuse that went unpunished. Lavelle is not respected by his parishioners, despite the centrality of the Church to their community. Amid the ruins left by the abuse crisis he carries little moral authority.

READ MORE

-

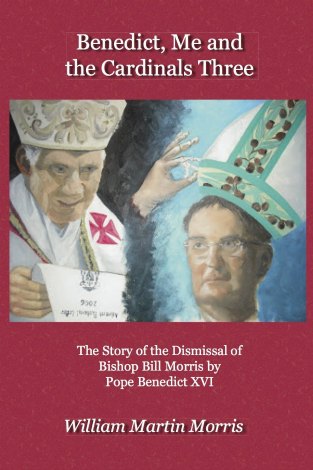

RELIGION

- Frank Brennan

- 24 June 2014

53 Comments

'My one new insight from reading Bill's book is that he was sacked because he was too much a team player with his local church ... the Romans hoped to shatter the morale and direction of those who had planned the pastoral strategies of a country diocese stretched to the limits as a Eucharistic community soon to be deprived of priests in the Roman mould.' Frank Brennan launches Benedict, Me and the Cardinals Three by Bishop William Morris.

READ MORE

-

AUSTRALIA

- Lily O'Neill

- 20 January 2014

6 Comments

The WA Government recently acquired 3414 hectares at James Price Point near Broome, in the continuing saga to develop the region's liquefied natural gas reserves. Meanwhile, the building of four LNG processing plants on Curtis Island, off Gladstone, Qld, is proceeding smoothly. While the traditional owners of James Price Point have received international attention, traditional owners in Gladstone have barely been heard.

READ MORE

-

ECONOMICS

- David James

- 08 February 2013

4 Comments

This week the Australian dollar reached its lowest point in three months. Tangible factors such as interest rates and trade with China influence its strength. But what really determines the direction of our currency is the whim of the currency traders. In that sense, the Aussie is is arguably the most 'unreal', or virtual currency in the world.

READ MORE