Search Results: derivatives

-

ECONOMICS

- David James

- 08 November 2017

3 Comments

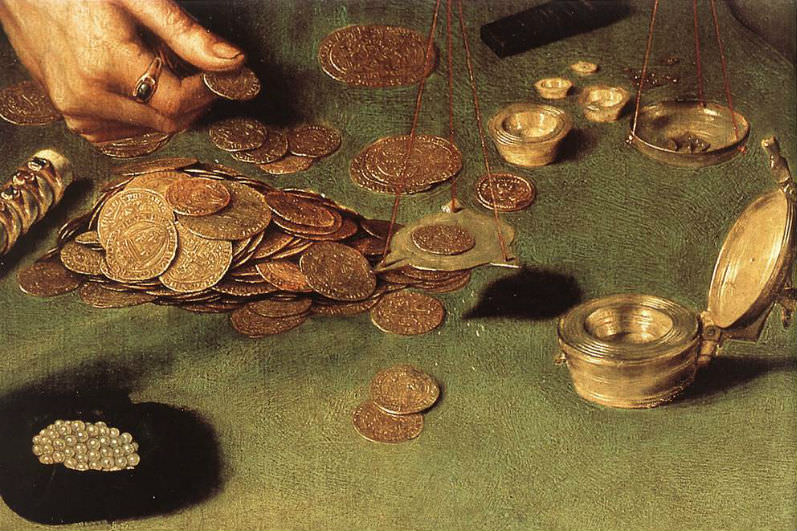

Once upon a time, usury was considered a sin and lending was subject to strict controls. Now, the world is in the grip of usury. It cannot continue. At some point it will have to be retired, or swapped to equity. A good place to start is third world debt, which is the most immoral variant.

READ MORE

-

ECONOMICS

One of the more interesting recent developments in finance has been the creation of Bitcoin and other crypto-currencies. They are being touted as a revolution in how we think and use money. Alternately, there are many who want to go in the opposite direction, back to the gold standard. Both sides have a common enemy: money whose value is determined by government dictate. Allowing governments to dictate in this way, they argue, is the core of the problem. To a significant extent, they are wrong.

READ MORE

-

ECONOMICS

One thing that is rarely done is a literary-style analysis of the language used in finance and business. It can quickly reveal the sleight-of-hand, even outright deception, that plague these powerful sectors. To take one example, finance language heavily relies on water metaphors, which are deeply misleading. It is unlikely that this is done deliberately; it is more probably reification (making the intangible appear to be concrete). But its consequences have been, and remain, devastating.

READ MORE

-

ECONOMICS

- David James

- 26 February 2016

8 Comments

It is not often that federal political parties exhibit courage. Labor's decision to change the rules on negative gearing is a rare instance. It targets what is most dangerous and unfair in our financial system. Expect howls of protests from powerful lobby groups if it ever looks like becoming policy. But these changes alone won't be enough to deal with the ills of the financial system. While they are designed to target the bias away from productive investment, they won't remove the attraction towards property.

READ MORE

-

ECONOMICS

- David James

- 19 January 2016

11 Comments

Low interest rates tend to change the understanding of risk; having high debt seems to be less of a problem because the cost of servicing it is lower. This cavalier attitude has been especially evident in Australian households, which have racked up more debt relative to the size of the economy than any other country in the world. The massive appetite for debt has been replicated across the globe. The world may have survived the era of casino money - just - but it is now facing another crisis.

READ MORE

-

ECONOMICS

- David James

- 14 September 2015

1 Comment

The recent ructions in the Chinese stock market set off great consternation in global financial markets, but for the most part this was a display of ignorance. One of the reasons China’s influence on global markets has been so beneficial, since at least 2007, is that its economy and financial markets are so different.

READ MORE

-

ECONOMICS

International Monetary Fund prescriptions have a long history of failing, and countries that ignore them are often the ones that do surprisingly well. Few have been asked to be more servile than the Greeks. When the IMF came in with what is amusingly referred to as its austerity 'plan', the Greek economy was expected to grow at over 2 per cent. After the 'plan' had taken effect, the country’s economy had shrunk by a quarter.

READ MORE

-

ECONOMICS

- David James

- 06 March 2015

8 Comments

The 2015 Intergenerational Report is reminiscent of a comment by that great 20th century philosopher and baseball player Yogi Berra: 'It’s tough to make predictions – especially about the future.' Many economic commentators have pointed out, rightly enough, that Treasury cannot even get its one year predictions right. Nevertheless, it is worth looking at how the 40 year forecasts are constructed to see the kind of thinking involved.

READ MORE

-

ECONOMICS

- David James

- 19 November 2014

6 Comments

Investing capital in the production of goods and services may create jobs, but it's not the best way to make money. It's more profitable to manipulate the financial system to create more money from money, which is why the finance sector does so well. The polarisation of wealth is less extreme in Australia, but we have our own capital-driven Ponzi scheme - the residential property market, which has become an exercise in making money out of money.

READ MORE

-

AUSTRALIA

- Andrew Hamilton

- 06 February 2014

10 Comments

Alcohol has a privileged place in polite society. All mood changing substances rely on a myth of a better life and relationships, but the alcohol myth is distinctive because it is rooted in high as well as in popular culture. Attempts to regulate its consumption and limit the damage it does will therefore always be unlikely to succeed.

READ MORE

-

ECONOMICS

- David James

- 04 October 2013

1 Comment

America is fond of claiming exceptionalism, which is usually little more than an indication of its attitude to moral accountability. But in one area America definitely is exceptional: the global currency markets. There is no risk of the market for American dollars drying up, which means that a default by the American government is, while significant, not especially relevant to what happens with the global trade in US dollars.

READ MORE

-

ECONOMICS

Religious authorities may not spend a lot of time pondering the nature of global financial systems, but the Pope's recent comment that 'money has to serve, not rule' suggests it can be useful when they do. Given scope to become rule makers, rather than just people who know how to exploit the rules, financiers have moved themselves to a position of mastery.

READ MORE